By The Staff | December 6, 2022

Despite challenges posed by the Covid-19 pandemic, boom times continued last year for American craft spirits.

The fast-expanding industry reached more than 13.2 million 9-liter cases in retail sales in 2021, representing an annual growth rate of 10.4%. In value terms, the market reached $7.5 billion in sales, representing an annual growth rate of 12.2%.

Presenting these statistics earlier today were the the American Craft Spirits Association (ACSA) and Park Street, sharing highlights from their 2022 Craft Spirits Data Project (CSDP) at the Annual Craft Spirits Economic Briefing in Brooklyn, NY.

The CSDP, first introduced in 2016, is a research initiative aims at providing a solid and reliable fact base for evaluating performance and trends in the U.S. craft spirits industry.

Other key findings from the 2021 report include:

U.S. craft spirits market share of total U.S. spirits reached 4.9% in volume and 7.5% in value in 2021, up from 4.7% in volume and 7.1% in value in 2020.

-

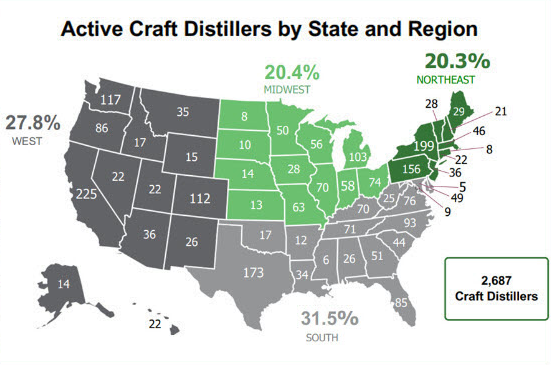

The number of active craft distillers in the U.S. grew by 17.4% over the last year to 2,687 as of August 2022. Active craft distillers are defined as licensed U.S. distilled spirits producers that removed 750,000 proof gallons (or 394,317 9L cases) or less from bond, market themselves as craft, are not openly controlled by a large supplier and have no proven violation of the ACSA Code of Ethics.

-

Craft distillery sales are almost evenly split between home state/tasting rooms (46.7%) and other states (53.3%) in 2021. “Direct shipping remains an important and critical opportunity for continued craft distiller growth,” the organizations say in a release.

-

Some states are “craftier” than others, with California, New York, Texas, Pennsylvania, and Washington leading the pack. Texas now is the third-most concentrated state, having taken the fourth slot last year in 2020. Washington fell into the fifth slot, having been third in 2020. The top five states by number of craft distilleries – CA (225), NY (199), TX (173), PA (156) & WA (117) — make up 32.4% of the U.S. craft distiller universe, and the next five states — CO (112), MI (103), NC (93), OR (86), and FL (85) — comprise an additional 17.8% of the market. The remaining states represent 49.8% of the market.

Reinvesting was again consistent among craft distilleries in 2021. On average, craft producers invested $337,100 in 2021 alone. This amount decreased slightly (-2%) from 2020, but the sharp uptick in the craft producer count bolstered the total amount invested in the U.S. craft spirits segment by 9% year-over-year to $826 million.

The primary motivation for investment listed by those surveyed was for additional production to meet demand, followed by construction to increase visitor space.

You can view the full 2022 Craft Spirits Data Project here.

Feature photo by Charl Folscher on Unsplash.